An immersive exploration of operating in international markets, IEMAV lets students assume the role of CFO and use various hedging strategies to mitigate the risks of foreign exchange.

Corporations operating in a global economy face currency risks that stem from fluctuating exchange rates. When a company’s sales currency differs from its cost currency, profit margins can be impacted by volatile exchange rates that cause, for example, differences between the settlement price of a resource and the ultimate invoice price. To minimize and protect against such risks, many firms hedge, counterbalancing one transaction against another.

Designed alongside, Karen Lewis, and esteemed professor of finance and economics, Wharton’s International Exposure Management and Valuation (IEMAV) simulation positions students as international Chief Financial Officers and presents them with multiple scenarios, each highlighting a different source of cash flow currency risk, and each with its own set of background details and information about a company, as well as the specific risks it faces. Using equations, sample exchange rates, or historical data (depending on the scenario), participants determine how to use the available hedging tools to their strategic advantage.

Through this innovative simulation game, students will learn how to evaluate problems encountered by the international financial officer of a corporation, including how to:

- Assess the company’s risk exposure due to cash flows that may be denominated in foreign currency and how to manage that risk;

- Consider the effects of inflation differences across countries on company competitiveness and profitability;

- Calculate the international cost of capital

- Understand issues involved with company valuations across countries;

- Understand basic differences in international tax treatments across countries and their impact upon repatriation of foreign cash flows, the cost of capital, and valuation.

The Game

IEMAV contains several scenarios that allow students to learn the intricacies of mitigating foreign currency risks. Though the simulation’s interface varies slightly from scenario to scenario, there are several common elements.

- Description/Scenario — the detailed information about a company and a specific transaction that involves currency risk. In addition, this paragraph describes the available hedging tools. The purpose of this section is to provide students with a real-world context for their decisions.

- Equation — the equations required for students to make a sound hedging decision.

- Data — any supplemental information that will be useful to participants. The information provided varies by scenario (e.g., sample distribution of exchange rate, historical data).

- Input area — the area that captures students’ hedging decisions and parameters.

Because the exercises are complex, IEMAV provides students with an opportunity to submit practice strategies and review the results before uploading their final answers. Students have the opportunity to practice their hedging strategies for each scenario by entering parameters and viewing the results.

Because the exercises are complex, IEMAV provides students with an opportunity to submit practice strategies and review the results before uploading their final answers. Students have the opportunity to practice their hedging strategies for each scenario by entering parameters and viewing the results.

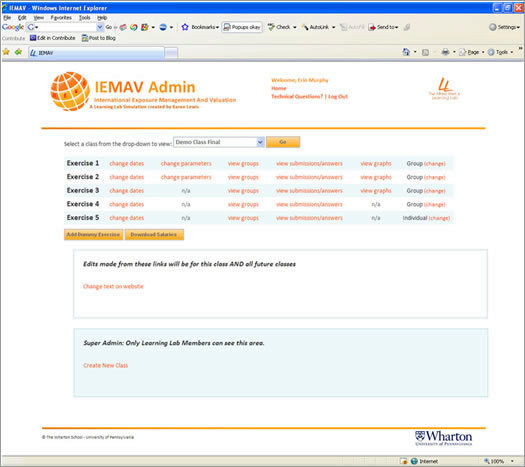

IEMAV contains administrative tools for both students and instructors, including an electronic invitation system to facilitate the creation of class groups. In addition, students can communicate via an online forum embedded within the application. The IEMAV instructor interface allows instructors to edit their scenario descriptions, retrieve uploaded student assignments, and access teaching tools that facilitate in-class discussion.