Professor of Finance, Economics

Executive Education

This flexible backtesting application enables students to design and test their own investment strategies, while at the same time analyzing an array of plausible, data-driven outcomes.

This flexible backtesting application enables students to design and test their own investment strategies, while at the same time analyzing an array of plausible, data-driven outcomes.

Developed in collaboration with award-winning Wharton Professor of Finance Robert Stambaugh, Backtester is the premiere learning platform for designing and testing original investment strategies. Following recent updates and new graphics, the user-friendly application remains one of the most effective tools for reinforcing core academic concepts without the complexities and costs of a commercial backtesting product.

Backtester can be tailored to fit any class assignment. Students will learn how to set up and run a backtest, and analyze the results of each test.

The Learner Experience

Creating an Investment Strategy

First, students create an investment strategy through Backtester‘s “wizard” interface. They are then guided through the process of defining a backtest’s attributes, which can be subsequently saved and executed at the user’s convenience. Once the test has been run and the results are generated in a series of analysis screens, students can employ a variety of in-app analytical tools to review and assess their outcomes.

Creating a Backtest

Depending on a course’s pedagogical goals and class assignments, students have the ability to control different aspects of their backtests, exploring variables as simple as the names and dates, and as complex as the number of securities per portfolio, their weights or their rebalancing frequency.

Running and Analyzing a Backtest

Once the screening criteria and partitions are selected, students are able to run their backtests against a wealth of Wharton’s archived real-world financial data, which is stored in the app, ready for use.

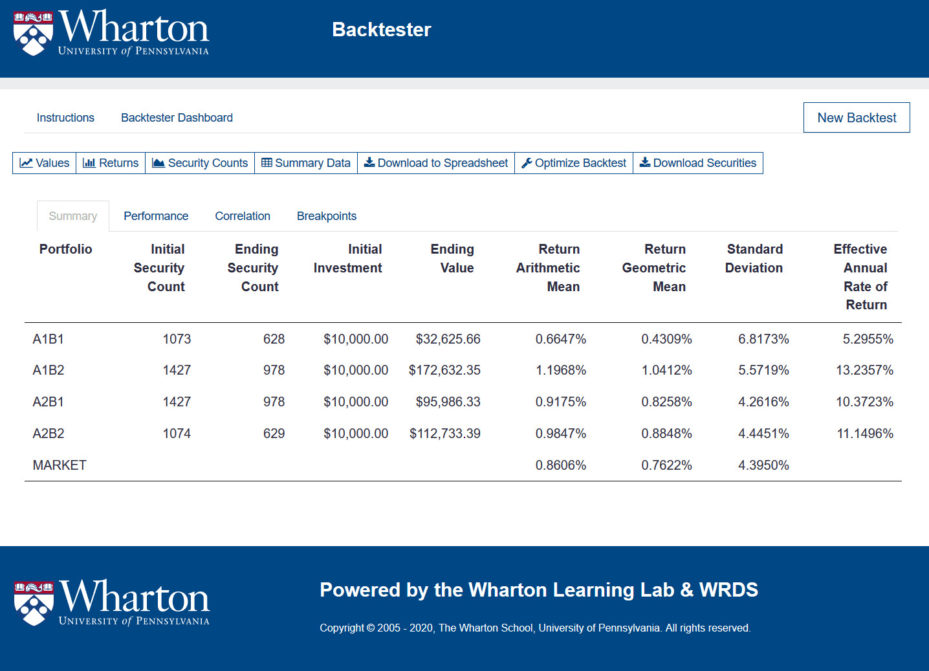

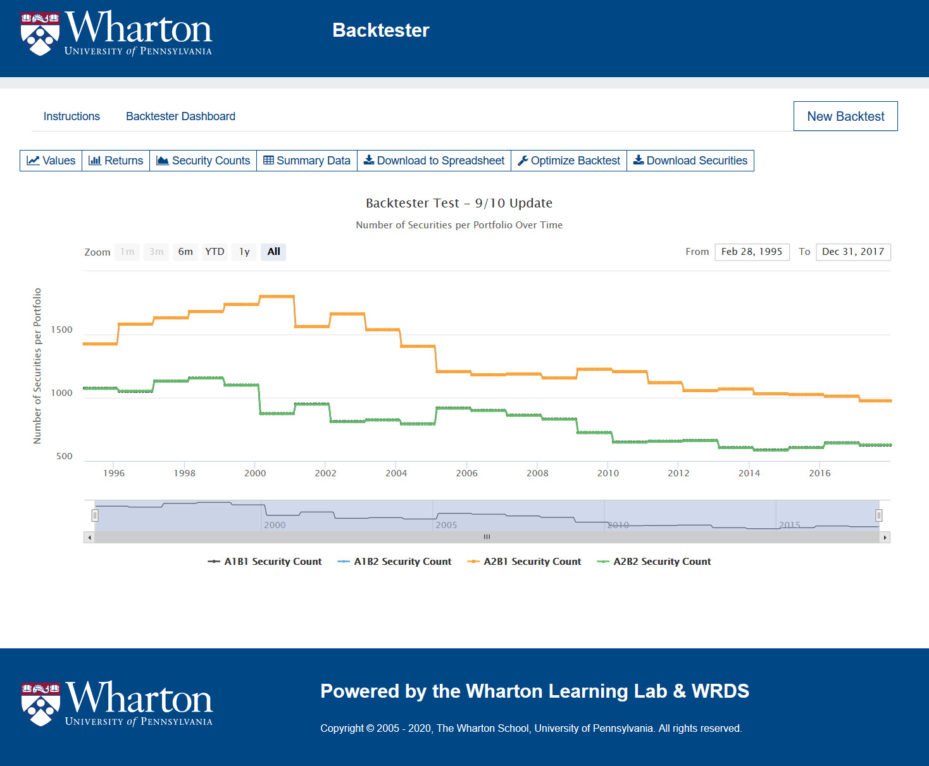

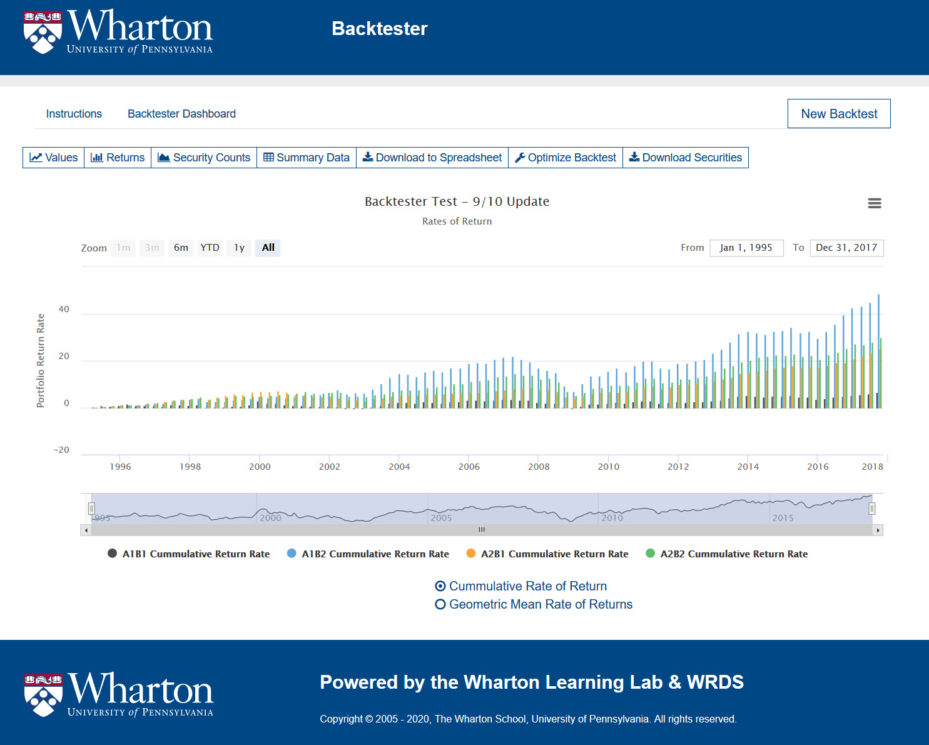

Backtester also contains multiple portfolio analysis screens for deciphering test results, like values, security count, returns (and rate of returns) over time, and a summary that recaps the test’s parameters, displaying investment performance info.

For more information about Backtester, email the Learning Lab team at: learninglab@whartonupenn.edu.